Donate a Lasting Legacy for Bears Ears

There are so many ways you can give smarter to support Bears Ears Partnership.

When donating to BEP through appreciated assets like Stocks or Mutual Funds, through tax-deferred giving vehicles like Qualified Charitable Distributions and Donor Advised Funds, or including Bears Ears Partnership in your will or trust, you are harnessing a powerful way to leave a lasting legacy for the future of Bears Ears.

"When I first visited the Bears Ears, I fell in love with the landscape and instantly felt connected with it. And thus began many years of exploring this extraordinary place. I clearly understood that love of place was not enough and that contributing time and money to the much needed protection for Bears Ears was paramount.

I know how important donations of unrestricted funds are to help to cover the cost of running the organization. I chose over the years to make donations of unrestricted funds to help cover expenses that restricted grant awards often don’t. It was a natural step for me to join and serve on the Board of Directors for Bears Ears Partnership. I am fortunate to be able to volunteer my time, and intend to do so for as long as I can.

I have seen the benefit that legacy gifts and planned giving are for this organization and I recognize that I can also help ensure the future of BEP's work by allocating Donor Advised Funds and including Bears Ears Partnership in my will. This is my way of assuring the good work goes on, preserving this place even when I can no longer directly participate.

The place that you love is still here. The land cannot wait, and Bears Ears Partnership can continue its work with your planned support."

–Sandy Maillard, Member, BEP Board of Directors

Transferring appreciated assets, like Stocks or Mutual Funds is a powerful giving tool for working-aged donors.

Stocks, mutual funds and crypto currency, or other appreciated assets, when transferred directly to BEP, is a powerful way to give beyond the tax benefit of individual cash donations. If you own the assets for more than a year, by transferring directly to BEP you avoid paying Capital Gains on the value of the asset and you get to deduct the amount from your income, thus significantly reducing your tax liability while benefitting BEP directly.

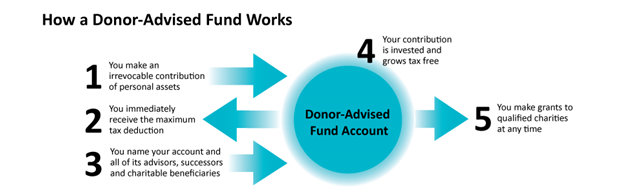

Donor Advised Funds (DAF) and IRA Rollovers directly benefit BEP, and your annual tax deductions.

An IRA Rollover (or a Qualified Charitable Distribution), if you are over 71 ½ years-old, is income you can directly transfer to BEP which you'll never be taxed on because it's never recognized as income, and it's a great way to benefit BEP. If you are over 73, you will be required to pay tax on this IRA income, and you can avoid paying tax on it by making charitable donations.

Donor Advised Funds are charitable investment accounts at a public charity (such as a Community Foundation) where a donor contributes cash, stocks, or other assets to receive an immediate tax deduction. The sponsoring organization invests these funds, allowing for tax-free growth over time. The donor then recommends grants from the fund to their favorite public charities over time, providing a flexible and tax-efficient way to manage philanthropic giving.

CLICK HERE to learn about building a giving plan.

CLICK HERE to watch Fidelity Charitable's video explaining how Donor Advised Funds work.

You can give to Bears Ears Partnership through your will.

Giving through your will or estate plan empowers you to make a generous gift that you might not be able to give during your lifetime. The process is free, and you can change your mind at any time. Planned giving will have an enormous impact on the future of the Greater Bears Ears landscape, and help us continue to protect this landscape for generations to come.

Download our Legacy Giving FAQ

When planning your estate, you may bequeath to Bears Ears Partnership:

- A stated dollar amount

- A percentage of your residual estate (what remains after gifts to loved ones and expenses have been paid), or

- A specific asset, such as securities or other marketable property

Sample Language to Share with Your Estate Planner:

"I give and bequeath to Bears Ears Partnership, PO Box 338, Bluff, UT 84512, the sum of __________ Dollars $ _______. (or,) _______% of the rest, residue and remainder of my estate], to be used for its general charitable purposes."

Legal name: Friends of Cedar Mesa, DBA Bears Ears Partnership

Address: PO Box 338, Bluff, UT 84512

Federal tax ID#: 35-2426283

Have you already included Bears Ears Partnership in your will? Let us know by

Bears Ears Partnership is a registered 501(c)3 nonprofit corporation. Our EIN is 35-2426283. All contributions are tax-deductible to the fullest extent allowed by law.

Bears Ears Partnership is a registered 501(c)3 nonprofit corporation. Our EIN is 35-2426283. All contributions are tax-deductible to the fullest extent allowed by law.